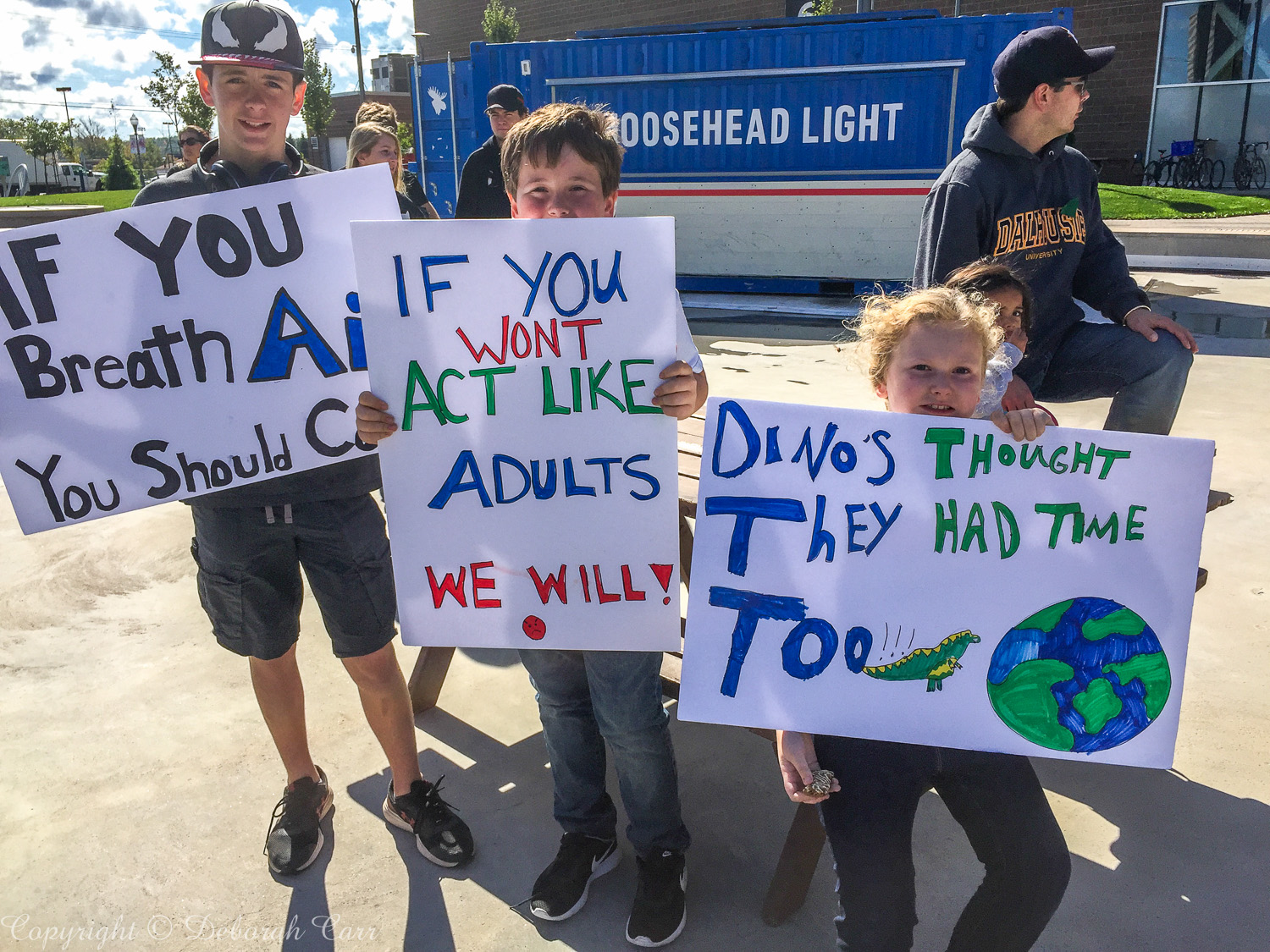

“If Blaine Higgs tries to start fracking in New Brunswick once again, he’s very likely to see the same resistance from First Nations and other land defenders that rocked the province nearly a decade ago.”

‘

“If Blaine Higgs tries to start fracking in New Brunswick once again, he’s very likely to see the same resistance from First Nations and other land defenders that rocked the province nearly a decade ago.”

‘

by Jim Emberger | Commentary Telegraph Journal, 28 June 2022

A recent Brunswick News editorial admitted Canadian fossil fuel companies might not profit on the misfortunes of the war in Ukraine (“Think long-term on resource projects,” June 17). That should have been a foregone conclusion.

Europe’s search for natural gas to replace Russian supplies logically pointed it toward nations that could fill its needs immediately. Many European nations also stressed that their climate crisis plans to reduce gas usage as quickly as possible were still in effect.

Canada would take years to become a European supplier, by which time there may no longer be a demand. Large fossil fuel projects are also generally planned for 30-year lifespans to recoup the massive financial investment involved. So, investors in Canada would risk their investments becoming stranded (essentially, lost) if the Europeans stick to their climate pledges.

FOR IMMEDIATE RELEASE

Nova Scotia court denies standing to environmental groups to challenge Minister’s project approval

HALIFAX/ TRADITIONAL TERRITORY OF THE MI’KMAQ PEOPLE – Ecojustice, on behalf of our clients, is appealing a recent Court decision which denied our clients public interest standing in a case challenging the Nova Scotia Minister of the Environment and Climate Change’s approval of a highway realignment central to the proposed Goldboro LNG project.

Ecology Action Centre and the New Brunswick Anti-Shale Gas Alliance (NBASGA), represented by Ecojustice, launched a judicial review in July 2021, challenging the approval for the rerouting of Highway 316 in Nova Scotia. The groups raised concerns about the greenhouse gas (GHG) emissions the project would enable as well as risks of environmental contamination due to abandoned gold mines in the area.

FOR IMMEDIATE RELEASE

May 11, 2022

Traditional Land of Wabanaki People/Fredericton – The Conservation Council of New Brunswick and the New Brunswick Anti-Shale Gas Alliance issued the following joint statement in response to Premier Blaine Higgs’ speculation that shale gas and liquified natural gas are solutions to war-induced threats to European gas supply:

Premier Higgs’ talk of ripping up the moratorium on hydraulic fracturing and building an LNG export terminal in Saint John to “save our neighbours internationally” is shortsighted, unrealistic and fails to protect New Brunswickers’ health and safety from the increasing threats of climate change.

In a landmark 2021 report, the International Energy Agency (IEA) concluded that to reach net zero emissions by 2050 no new oil, gas or coal development is possible if the world is to avoid a global temperature increase of 1.5°C.

by Jim Emberger – Letter to the Editor, Telegraph Journal & Daily Gleaner

A recent editorial in Brunswick News accused the Minister of the Environment, Steven Guilbeault, of misfeasance, because he isn’t promoting Canadian fossil fuel exports to Europe. Besides displaying a lack of understanding of the climate crisis, the editorial argument is without merit.

To begin: Guilbeault is the Minister of the Environment. Protecting the environment is his primary mandate. He doesn’t work for the industry promoters that run the Natural Resources ministry.

Next: the overarching threat to the environment everywhere is the climate crisis, referred to in Guilbeault’s Mandate Letter as an, ‘existential crisis’, the solution to which is to stop using fossil fuels.

Commentary by Jim Emberger, Telegraph Journal, The Daily Gleaner, The Times Transcript, March 1, 2022

Martin Wightman forsakes scientific reasoning for political rhetoric, by suggesting that it can make climate sense to burn more fossil fuels, so long as Canada can profit by it.

The single salient fact, stated by virtually the entire global climate science community, is that there cannot be any new fossil fuel development if we want to stop the climate catastrophe – period.

The provincial government is preparing to write New Brunswick’s next five-year climate action plan and the Standing Committee on Climate Change and Environmental Sustainability is seeking public input until Feb. 24, 2022. The following are comments prepared and submitted by NBASGA.

Read the full text below, or download the entire pdf with references: NBASGA Comments to Climate Change Committee

Commentary by Jim Emberger, The Daily Gleaner, The Times Transcript, August 19, 2021

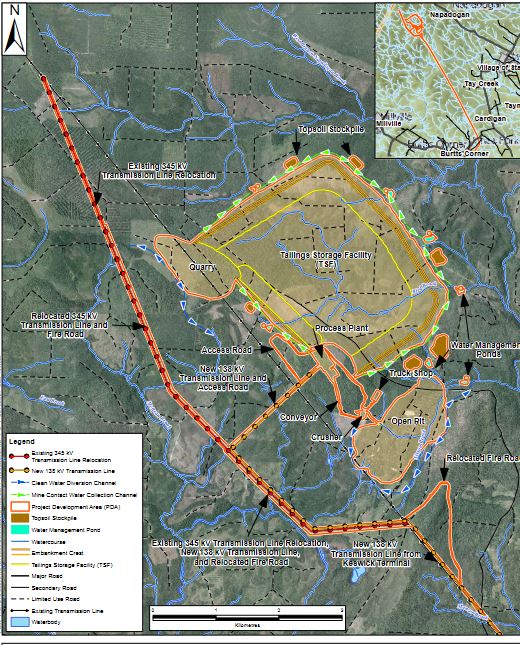

Martin Wightman’s recent column on the future of natural resource mining in Canada (“Don’t let China corner the market on critical minerals”) made some valid points – but also had some serious oversights.

As part of the decision process surrounding future mining projects, he says we should “mitigate the environmental concerns of mining and ensure local communities aren’t decimated.” I’m sure most people would agree with this. But then he makes the contrary suggestion that we must also reduce government regulations on mining, and change our “attitude” toward it as well.

In early July, NBASGA, along with member groups, Kent County Council of Canadians and Notre Environnement, Notre Choix, and our friends and allies from Kobit Lodge (representing Elsipogtog First Nation), sent letters to federal Minister of Justice Lametti concerning the final report of the Civilian Review and Complaints Commission (CRCC), which was investigating RCMP actions during a 2013 raid in Rexton, NB.

(June 18, 2021) The following comments were submitted to the New Brunswick Energy and Utilities Board on behalf on the New Brunswick Anti-Shale Gas Alliance, Inc., (NBASGA) a collaboration of Anglophone and francophone civic groups across the province, reference a planned gas pipeline expansion in Havelock, NB.

(Information about the project and the Energy Utility Board process can be found here:

https://nbeub.ca/uploads/2021%2006%2003%20-%20Notice%20-%20Public%20Comment%20Opportunity.pdf)